Bitcoin price has been difficult to chart during most of 2015, so I have not updated the count for quite some time. I took a look at the charts again and propose a bullish count for the bitcoin daily chart, seen below. Most of 2015 was spent in a tight range between about 300 …

Category: Uncategorized

Jul 19

Bitcoin Price Commentary – July 19th, 2014

Hi Everyone, At this time, I am still waiting for Bitcoin price to make a decisive move in one way or the other. I wrote the following elsewhere on the web, so I decided to post it here for everyone else to see. Good trading! From my post last night, I show through my …

Jul 18

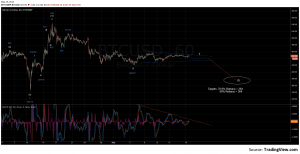

BTC Daily Squeeze – July 18th, 2014

Another daily squeeze has formed on the daily chart for Bitcoin. The last one did not follow through with its move. Let’s see what it has in store this time. The squeeze triggers once the yellow Bollinger Bands move outside of the dark blue Keltner Channel. So, we are in waiting mode right now. After …

Jul 14

Bitcoin / USD Hourly Wave Count – July 14th, 2014

I found time to update the hourly Bitcoin / USD wavecount – let’s dive into the details. The recent top at $683 is labelled as the end of Major 1, meaning Bitcoin price is currently working on a Major 2 retrace. The drop down to 538 caused an overlap with the labelled Minute wave (1) …

Jul 04

Long BTC on Daily Momentum Squeeze Indicator

Hello everyone. Long time since I’ve made a post as a result of being busy with my day job. Getting back into it, but don’t have time to update the EWave count. There’s a great momentum indicator I want to teach everyone about. In trading, we want to identify periods where price is setting up …

May 19

Bitcoin / USD Wave Count Update – May 19th, 2014

Bitcoin price has been difficult to count and indecisive for the past month. Let’s start this update by taking a look at the daily chart for clues on the current trend. I notice the following important points from the daily chart. Price has failed to stay above the 21 day EMA (listed on top left …

- 1

- 2